- NEWS

- GAMES

- PLAYSTATION

A Grand Theft Auto Online Gamer Was Wandering Across Los Angeles When They Spotted A Landmark They Recognized The Residence As Being The Same One Their Video Game Avatar Had

- XBOX

A Grand Theft Auto Online Gamer Was Wandering Across Los Angeles When They Spotted A Landmark They Recognized The Residence As Being The Same One Their Video Game Avatar Had

Players Of The Sims 4 Have Reported That Their Once Friendly Sims Have Turned Hostile And Started Fighting For No Apparent Cause

- PC/MAC

A Grand Theft Auto Online Gamer Was Wandering Across Los Angeles When They Spotted A Landmark They Recognized The Residence As Being The Same One Their Video Game Avatar Had

Despite The Controversy Surrounding The Game's Monetization, Blizzard's Diablo Immortal Has Made Over $300 Million Globally

- NINTENDO

- STEAM

- FORTNITE

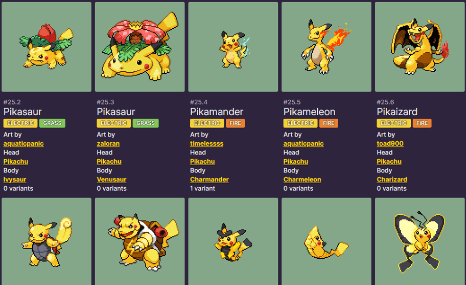

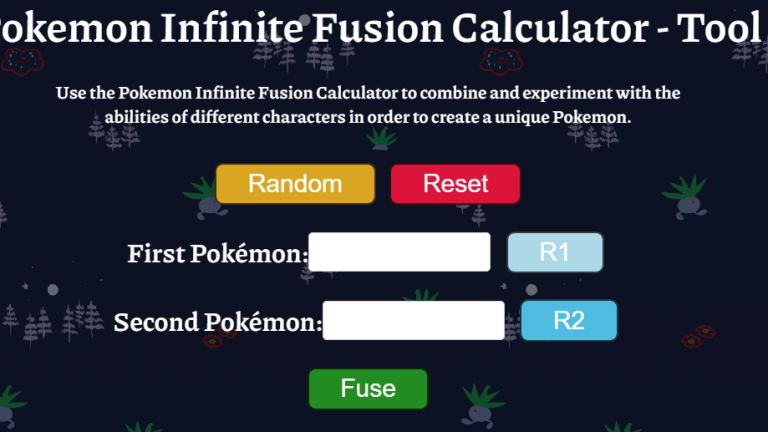

- POKEMON

- APP STORE

- GOOGLE PLAY

- PLAYSTATION

- GEAR

- TECH

- SOCIAL

- ESPORTS

- Follow us

![Mortal Kombat Komplete Edition Steam Key (PC Steam Key) [ROW]](https://happygamer.com/wp-content/uploads/2023/10/1ea06c9f0f51a3fe339606df478a3bb7.png)